The challenge:

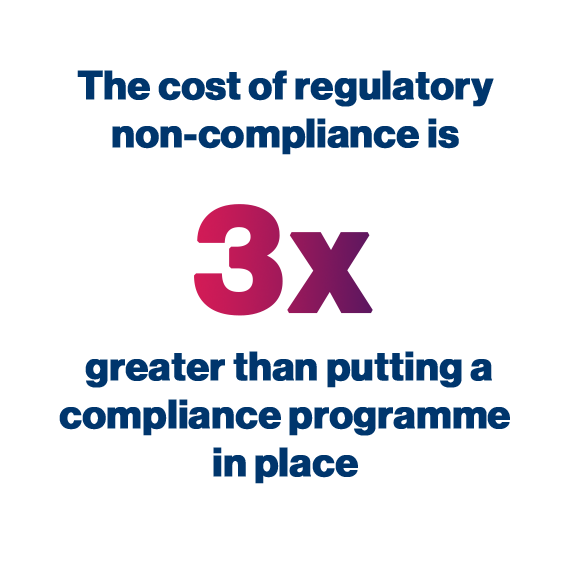

Financial services organizations are among the world’s most heavily regulated. They are subject to an ever-growing set of regulations and face immense pressure to comply with each requirement to ensure their customer data is protected.

Data-at-rest security requirements are found within PCI DSS for payment card information, GLBA, SOX/J-SOX, NCUA, data privacy and data residency laws. At the same time, financial services organizations also have to secure the same types of sensitive data that other companies do, such as employee and partner personal information. This means they need to maintain compliance with broader privacy regulations like GDPR, CCPA, and more.

Ensure your organization keeps a handle on where your risk on personal and sensitive data resides in your organization through risk scoring and mapping

Discover over 300 predefined and variant types of data, including credit card, bank and insurance information

Ensure PCI DSS 4.0, GLBA, SOX/J-SOX, NCUA, 23 NYCRR 500, GDPR and CCPA compliance including many regional and country specific regulations

Thousands of companies trust us to discover their sensitive data, including IDC, Evry and Elavon

The solution:

Enterprise Recon by Ground Labs delivers advanced discovery, management and remediation capabilities for all critical data across on-prem and cloud environments.

Organizations achieve financial services compliance

with Ground Labs

The relevance of data discovery for financial services compliance

In this article, we’ll explore the relevance of data discovery for financial services companies in complying with regulatory obligations.

A guide to PCI DSS v4.0 compliance for payment service providers

In this post, we explore what the latest PCI DSS v4.0 changes mean for PSPs and how data discovery supports sustainable compliance.