The challenge:

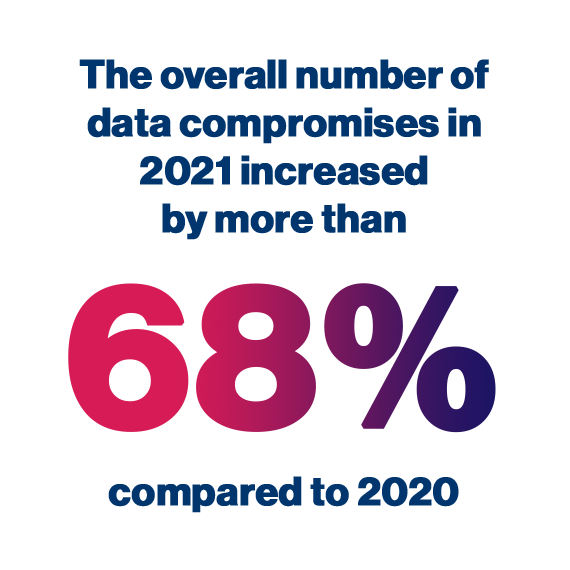

The sheer volume of card payments around the world offers a tempting and lucrative opportunity for hackers. According to the Federal Reserve, in 2018, Americans made 131.2 billion card payments worth $7.08 trillion. But as card payments grow, credit card fraud and theft grow too: in 2019, the Federal Trade Commission received 271,000 reports of credit card fraud in the US.

At the same time, the Payment Card Industry Data Security Standard (PCI DSS) is constantly evolving. PCI DSS was created to ensure that card transactions are secure throughout the entire payments ecosystem. PCI DSS 3.2.1 is currently the gold standard for organizations handling payment card information, but will be replaced by its more stringent successor, PCI DSS v4.0, from March 2024.

For any business processing payment card data, maintaining compliance with the latest PCI DSS requirements is critical. Failing to comply with the PCI DSS comes at the risk of financial penalty as well as increased exposure to data compromise. A breach can mean a potential loss of revenue, customers, brand reputation and trust.

Trusted by more than 300 QSAs across the globe as the go-to cardholder data discovery solution for PCI DSS 4.0 onsite assessments

Comprehensive capability to meet PCI DSS 4.0

Ensure PCI DSS 4.0 compliance with Card Recon by Ground Labs

Thousands of companies trust us to discover their sensitive data, including Virgin, Vodafone and 1-800-Flowers

The solution:

Our solutions enable merchants, service providers and QSAs to quickly scan, identify and remediate PCI DSS data across workstations, point of sale devices and servers. Card Recon is a portable card data discovery tool that can run without installation on multiple supported platforms and can be executed from removable storage media, making it the perfect solution for PCI DSS scope validation.

QSAs achieve PCI DSS compliance

with Ground Labs

Navigating the future of payment security: Insights from PCI London 2024

We share our key takeaways from the 25th PCI London event, centered around the upcoming PCI DSS v4 deadline and the impacts of emerging tech.

What's next for payments security? 2024 trends and predictions

In this post, we explore some of the key trends and predictions for payments security in 2024, from mobile wallets to automation and more.